Have you ever asked yourself why I am not able to achieve my dreams in a constructive manner? What do I do wrong that I give up after a few weeks of working towards my dream? Why are my finances in such a disarray?

If you are looking for answers to any of these questions, then you are at the right place because today we will be answering the question ‘what is goal based planning?’ with this article, we will be looking into the goal-based approaches to financial planning and what to do to become better at goal based financial planning.

Our life goals when it comes to financial plans may be different, but all the readers will have one thing in common, and that is the motivation to achieve their dreams. However, to make dreams come true, one has to make tangible changes, financial decisions and asset allocation that eventually allows you to open that business, go on that trip or have the wedding you have always dreamed about.

But before we delve deeper into meaningful goals and financial goal setting, let us first begin from the basics

What is Goal Based Planning?

Each of us has a different perspective to look at life, and someone who perceives through planning and execution will have something you can learn from. To break down your life, progress and personal finance on the basis of goals that can be attained gives you the flexibility of managing your assets to become better at disciplined investing and returns.

Goal based planning, therefore is simply the outlook in which a process is broken down into tangible achievable steps, rather than looking at the bigger picture that can make your dreams too ambiguous to be achieved.

An example of this can be your children’s education. You dream of seeing your child graduate from Harvard, but it becomes a goal, when you start setting a college fund, help your child with their studies, set an investment plan for extra tuitions etc.

As you see this difference between a goal and a dream, it becomes clear that goal based planning is simply looking at your dreams in a realistic manner.

What is Goal Based Financial Planning?

Financial planning simply means to have a deeper insight into your current information about wealth management, mutual funds, income statements and any investment strategies you have. After reviewing these finances, the next step you take is to set goals about how you want to see your financial independence, and taking tangible steps to achieve your goals.

Goal based financial planning then simply breaks down your overall goals for your finances, with the help of financial goals to be turned into successful wealth management and investment strategies that give you the space for a risk appetite.

Although, you might now ask yourself why even is goal based financial planning important? The answer to this question is linked to another question, what is goal based planning?

Simply put, financial goals are critical in clarifying complex long term goals into easily achievable short term well defined financial goals. Your larger goal can be to buy a yacht, but your finances might not allow it. However, with goal based financial planning, you can work to achieve this dream through goal based investing and asset allocation. Financial goal based planning, therefore makes your dreams come true.

What is Goal Based Approach?

Goal based approach is a specific thinking style and mentality that helps you better plan your life. Your dreams, although are intangible, but they still offer a final end result you want to achieve. Once you set goals to reach that end result, your goals can then be your template on how to achieve your dream.

You take the first step of turning your dreams into reality, by approaching them through a goal based perspective. Setting financial objectives is another way of gaining financial independence, while your financial advisors and financial planners are coaches who can better plan your financial goals.

To justify the need for setting goals, one study conducted by Frontier can be included. The study included a review of data from over a 1000 students, and they were asked to perform various tasks in a goal-based and non-goal based approach. Time and again, results revealed the same thing; set goals increase performance, productivity and persistence of achieving a task, irrespective of the nature of the task and skillset of the participant.

This is why, in life or in business, when you are looking to make improvements, goal based approach is the answer to your queries.

What is Goal Based vs Cash-Flow Based Planning?

Within financial goals and goal-based planning, there are two types of financial planning that can be used; Goal-Based and Cash Flow

When we asked a financial advisor what their go-to system of financial plan is, they gave the response that it is similar to asking a doctor, if they prefer an X-ray or MRI. They are two completely entirely different approaches to financial wealth management, meant to achieve different end results.

With goal-based planning, importance lies in reviewing assets, savings and investment portfolio, which then proceeds to setting a comprehensive investment strategy, with the basic understanding that stocks are likely to change.

On the other hand, cash, flow approach can lead to an improvement in investment portfolio, but it begins by looking at spending numbers from an accounting perspective. This is a very detailed outlook into your income tax, compensation, spending and then determines your risk appetite.

So when you do goal-based planning, you ask the question, ‘Will I be able to reach my goals and if yes, how? What is my retirement plan?’ Contrarily, if you invest in cash-flow approach, then you ask, ‘When to avail employee stock? How much tax do I owe? My income tax returns?’

Both achieve your financial independence, but in very different ways.

What are the Steps Involved in Goal Based Planning?

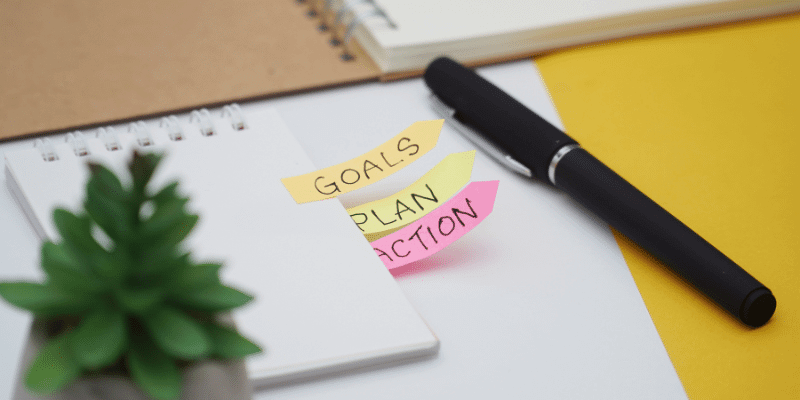

Going back to goal-based financial planning, it is also a detailed process that requires specific steps to lead to achievements. However, in goal-based planning, two steps count the most and they are:

- Prioritizing Based on Life Stage

Your financial goals have to be personalised to your needs. As a 20-something, you cannot be expected to have a savings account, emergency fund and investment portfolio, while only having an emergency fund at 60 without diversifying your portfolio is also not correct.

So, look into your earnings, what you can afford and what does not need to be included. Afterwards, you can plan your finances to process your dreams into reality.

- The Art of Setting Clear Goals

If you have a financial plan, your processes are intact, but you do not have a clear vision then you will not be able to budget appropriately. When setting financial goals, the aim is to be as specific and concise as possible.

Instead of goal setting for children’s education, set goals of 50k for child’s tuition. Instead of early retirement, set goals of affording living without active income by 55.

What is Goal Based Financial Planning with Example?

After reading up to here about financial planning process, emergency funds and retirement planning, but you might still be confused about what it means for you.

To explain it simply, we can provide an example of hiring a wealth manager as a financial advisor to become more financially independent. Your wealth manager will first ask for your financial data, and if you are going for cash-flow approach then this step will take weeks, if not months. Then your financial plan will be setup, with well-defined financial goals and savings or investments that need to be made. The investment firm your wealth manager belongs to will emphasizes investing, as investment firm’s clients measuring needs are accredited through a diverse portfolio.

If you cannot afford a wealth manager or financial planners, then to further break down what is goal based planning for your financial needs, there are two steps that you can follow:

- Plan Your Finances Systematically

If you are looking for early retirement and ways of managing your hard earned money in an effective manner, then you have to start by planning your finances. Begin with looking into your spending, then review your savings and finally begin on your investment.

The steps involved in financial planning systematically is to go step-by-step, only then you will be able to reach your milestones at the same rate or else you may be confused. If you are investing, then your retirement nest egg will be diversified if you start investing and depending on market conditions, you can achieve your goals in months or years.

- Tax Planning

What we often overlook in financial planning is tax planning because it constitutes a big part of your income and savings. If you conduct a comprehensive tax plan, you can be sure of avoiding any tax litigation or liability, allowing greater room for meeting individual needs. This will lead to progress in meeting your budget and managing your expenses in a smart way.

Sample for Basic Goal-Based Investment Plan

If you are short of ideas but want to have a mart financial portfolio, then this sample is meant to get you started on your savings, retirement and investment. Although, keep in mind, this is a highly generic and common form of goal-based investment plan, therefore you can personalize it

- Step 1 – review

Before you even begin investing, first you need to review your assets, to determine where you stand. Your review will save you from making extra expenses

- Step 2 – tax planning

Taxes are another form of expenditure that need to be considered before making any investments. Your focus on tax planning is to look at the time horizon for where you want your investment portfolio to be and it will impact your flexibility in the longer period as well

- Step 3 – savings

Although, you want to invest to increase savings, you must also have a savings account that is not linked to your investments.

- Step 5 – an emergency fund

The emergency fund serves the same function as a savings account. It is meant to be a safety net for any financial situation that might arise.

- Step 4 – investment

Now to the good part! After you’re done with safety nets and required expenses, your leftover wealth can be invested. You can invest in mutual funds, which is the safest way of generating passive income or you can buy stocks of established big names, like Microsoft, Johnson&Johnson, and Nestle.

- Step 6 – retirement plan

Your investment portfolio is an outlook into your retirement plan and can determine if you are able to achieve early retirement. So look at it as an investment into your future to support your lifestyle.

Up until now, we hope you are able to effectively answer what is goal-based planning? It is a simple yet detailed process of meeting financial independence in a planned out and comprehensive manner.

However, for effective goal-based planning, it is important to know your finances effectively well and to set personalised and clear goals, such that you meet your specific life goals and any other financial goals. Remember, investments, savings, emergency funds and any other financial goals are only tools to achieve your greater goals in life.